Despite the fact that SBA microloans only provide nearly $50,000, they supply competitive desire premiums and repayment conditions. They even have flexible eligibility requirements — building them a good selection for borrowers who can’t qualify for other business loans.

An extensive assessment of your monetary health is fundamental to securing a small business loan. Evaluation your money statements, like equilibrium sheets, money statements, and funds movement statements.

Considering the fact that many lenders demand a 1- to two-yr business record to qualify for financing, obtaining a secured startup business loan could possibly be tough.

Each kind of lender has its have set of standards and loan goods, so being familiar with these will assist you to narrow down your choices.

You may have to offer personalized or business assets to secure one particular of these online loans. iBusiness Funding can difficulty resources in as tiny as two days.

The whole cost of a business line of credit will count on your curiosity rate and any expenses. Contrary to a business time period loan, on the other hand, You simply pay back interest within the hard cash you attract.

A small business line of credit is usually available as unsecured personal debt, which implies you need not put up collateral (property that the lender can sell in the event you default on the debt).

SBA loans are issued by banks and credit unions and partly guaranteed through the U.S. Small Business Administration. These loans supply minimal curiosity costs and lengthy repayment terms, and can be utilized for lots of uses.

Triton Capital stands out being an online equipment lender for borrowers with reduced credit scores. Triton Capital can finance new or utilized equipment in a number of industries.

Because you’re securing your loan with collateral, It's also advisable to validate that your whole collateral information is precise.

You should consider which how to obtain financing for a small business of one's business belongings can be used as collateral. Real-estate, equipment, stock and invoices are amid possible solutions.

Ignoring Loan Terms: Overlooking loan conditions and terms may end up in sudden costs or unfavorable phrases. Diligently overview and negotiate phrases to secure the most beneficial offer on your business.

For example, it might take months to acquire your cash right after remaining approved for an SBA loan, Even though you may cut down this timeline to 2 weeks by working by having an SBA-most well-liked lender.

Repayment knowledge: We consider Every lender’s name and overall business practices, favoring lenders that report back to all significant credit bureaus, give trustworthy customer care and provide consumer benefits, like free of charge business coaching As well as in-person assist.

Val Kilmer Then & Now!

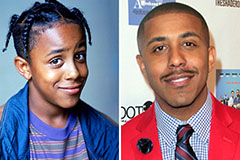

Val Kilmer Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!